The “Deal Of The Rich” Will Not Benefit Developing Countries

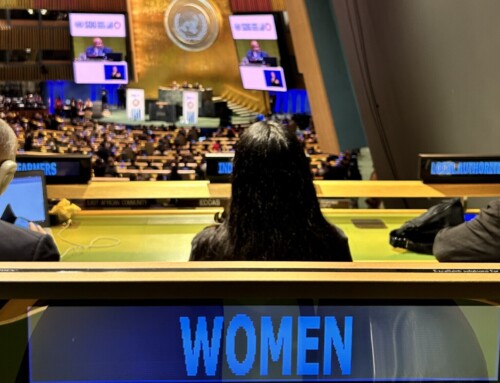

The Women’s Major Group joined 250+ civil society organizations in endorsing the Global Alliance for Tax Justice’s (GATJ) statement rejecting the G7/G20/OECD tax deal.

The statement was submitted by GATJ to all member States of the United Nations, underlining our and the G77’s longstanding call for the establishment of a global tax body at the UN, to set in motion an inclusive intergovernmental negotiation process that will ensure equal taxing rights of all countries and stop all forms of tax abuse by multinational corporations and the wealthy elites.

The COVID-19 pandemic and its impacts present a historical opportunity to reform global corporate taxation and transform our tax systems to make them more responsive to the needs of people and the planet. It is unconscionable that the solutions offered by the world’s elite countries only serve to reinforce inequalities in the global tax regime that have long excluded the voice and interests of developing countries and peoples in the Global South.

The Global Alliance for Tax Justice and many in the tax justice movement were critical regarding the leadership role of the OECD, which is a club of the rich, to reform international tax rules. To give its leadership the veil of legitimacy it created an Inclusive Framework (IF), which has so far barely gone beyond rubberstamping the Group of Seven (G7) “deal of the rich”. The proposals in the OECD-led Inclusive Framework’s statement on July 1 for new global tax rules, do not address the fundamental problems of the current international tax architecture. It is designed to accommodate the recent deal of the G7 on a global minimum corporate tax rate of 15%, and disregards the suggestions, proposals and reservations that a number of developing countries have put forward throughout many years of work